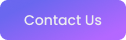

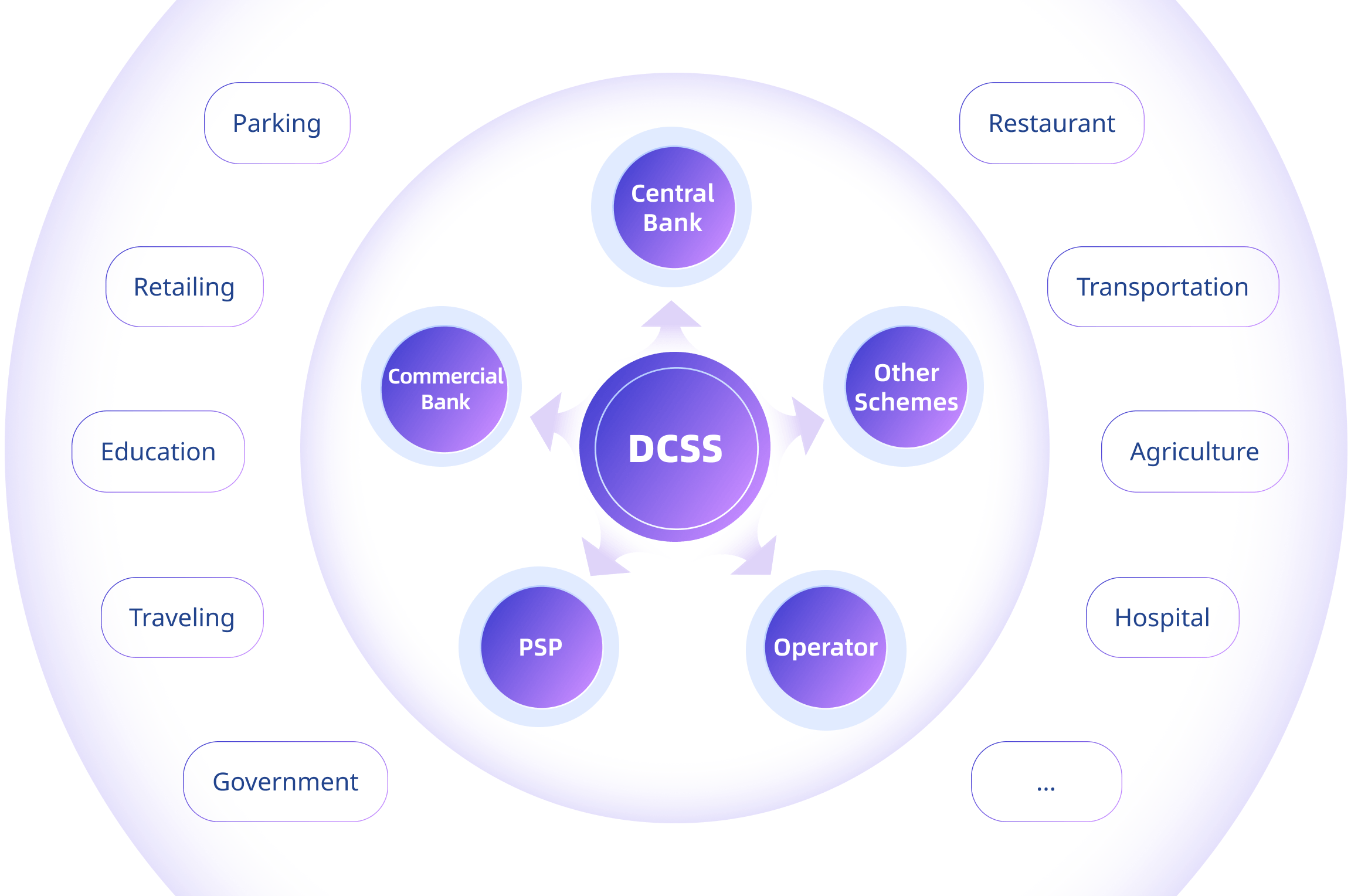

MuRong Domestic Card Scheme System (DCSS) is a fundamental system for card scheme that integrates card issuance and card switch capabilities to promote omni-channel payments, enhance operational efficiency, and strengthen regulation.

The system effectively connects banks, PSPs, mobile-money operators, and other participating institutions, and provides a one-stop solution for card issuance, transaction switch, clearing & settlement, dispute handling, risk control, and value-added services.

On the basis of fully meeting the international standards such as EMV and lSO, the system also defines the national/regional specific standards, which can be used to rapidly construct the national/regional inter-bank payment and settlement infrastructure as a exchange center with complete variety products & comprehensive business functionalities for a wide range of participating financial institutions. The system can effectively support the convenient, stable and safe operation of payment business.

Features Capacities

Card Issuance

Physical card issuance

Virtual card issuance

Multi-tenant support

Standard

Comply with ISO & EMV standards

Follow PCI DSS guidelines

Risk Control

Real-time model Batch model

Risk & anti-fraud rules Audit trail

Dispute Handling

Dispute proposal

Dispute review

Dispute resolution

Omni-channel

Transactions

Omni-channel Transactions

POS, ATM & WEB

Mobile & USSD

Various of transaction types

Participant

Management

Participant Management

Banks

PSPs

MMOs

Other FIs

Clearing &

Settlement

Clearing & Settlement

Flexible fee configuration Automated settlement Instant settlement

Value Added

Services

Value Added Services

Points

Coupons

Campaign management

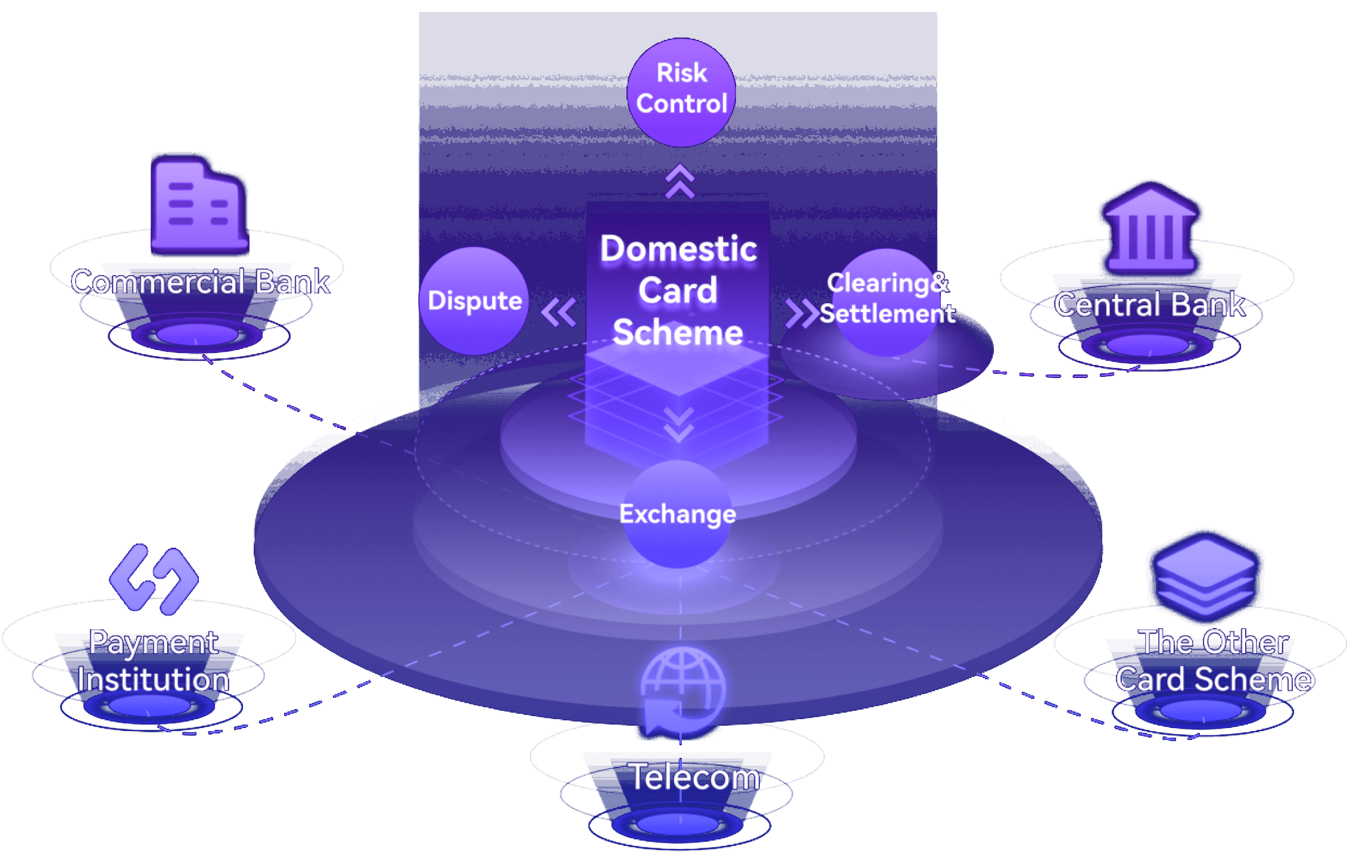

Our Product Features

PRODUCT FEATURES

Our

Product

Benefits

Promote Digital Payment

Support the use of diversified payment tools from multiple channels and promote digital payment to meet the needs of various social and economic activities.

Efficient Operation

MuRong DCSS provides the automated process which can improve the operation efficiency for system owner and participants.

Reduce Costs

The use of the advance architecture with open-source software can significantly reduce the infrastructure costs and the IT operation & maintenance costs. The easy and quick integration can also save the costs for participants.

Improve Efficiency of the Use of Social Capital

The high success rate of transactions and the quick & automated settlement can speed up the turnover of social capital which can promote the economic development.

Strengthen Regulatory

The transactions are process within the country and the data are kept in country which can strengthen the regulatory for payment & settlement to safeguard and defuse financial risks in the field of payment and maintain financial security.

Our Product Values

PRODUCT VALUES

Short Term Value

Strictly guard against systemic risks

Improve the universality and fairness of industry ecology

Reduce the uncertainty of financial innovation

Create the value of industry safety norms

Medium Term Value

Control corruption

Combating money laundering and other illegal acts

Realize stable benefit income Provide support for national finance

Long Term Value

Promote the construction of social credit system

Strengthening the efficiency of financial supervision

Provide data support for macro-control

Enhance financial precision service capability

Want To Get Started?

Get In Touch Or Download Our Brochure.